Does innovation create more value when based on science? Yes, but...

A new study concludes that corporate innovations built on scientific discoveries create more value but also entail more risk

For as long as there have been corporations, there has been a relationship between them and researchers. Indeed, the Dutch East India Company — one of the most important precursors of today's corporations — hired scientists and maintained a strong knowledge network throughout its history. In the late 20th Century, corporate institutions such as XEROX parc and Bell Labs (now owned by Nokia) created genuine scientific breakthroughs, just as universities expanded the number of centers trying to connect scientific research to corporate innovation programs. Although these collaborations can be controversial, the ever-growing need for external funding at most private and public universities means that the relationships between corporations and scientific research centers continue to grow.

The long history of companies working with scientific discoveries has left a legacy of anecdotal successes and failures, yet, surprisingly, there is a lack of detailed analysis that explains and quantifies the dynamics between scientific research and business innovation. A new working paper from Martin Watzinger (Münster), Joshua L. Krieger (Harvard), and Monika Schnitzer (Ludwig Maximilian) provides valuable insight into these connections.

The researchers' goal in this analysis was as straightforward as it was challenging: attempt to determine the value-creation role of scientific discoveries in the innovation efforts of corporations. This question is essential since many firms have well-established links between their Research & Development (R&D) teams and scientific institutions. Moreover, note the authors, "while scientific advances are the bedrock of industrial R&D, only some of those activities build directly on science translating discoveries from laboratories and scientific publications into novel inventions and commercial products." Other corporate innovation efforts "rely only indirectly on science experimenting, tinkering, optimizing and inventing without the aid (and/or constraints) of the 'republic of science' but still using tools and technologies enabled through centuries of scientific advance."

The challenge, then, was to determine the extent to which firms' use of scientific knowledge "affects the value they capture from those innovations."

Study

For their analysis, the authors combined several data sources from which they built a dataset of information about 1.1 million U.S. patents, each of them tagged with three markers.

The first marker was monetary value, as defined by the "abnormal stock market return of the filing company within a narrow window around the grant date of the patent." The second marker uses a concept developed by Mohammad Ahmadpoor and Benjamin F. Jones called a "distance." As the authors explain:

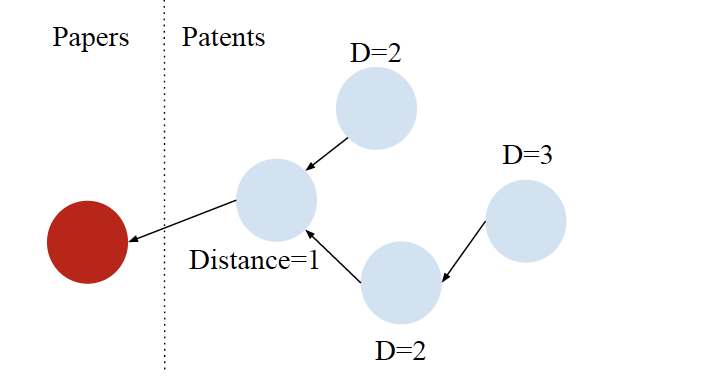

A patent that directly cites a scientific paper is assigned a distance of one (D=1) to science. A patent that cites a (D=1)-patent but does not cite a scientifc article itself has a distance of two (D=2), and so on. The distance for each patent to science is thus defined by the minimum citation distance to the boundary where there is a direct citation link between patent and scientific article.

Put simply, the more a patent application relied on direct scientific research to make its case, the lower the distance. The authors provide two examples to illustrate this approach. The first is Coca-Cola's 1997 patent for a machine that keeps packages cold. The company worked alone to develop a vending machine refrigeration system that cools stored soda with a water mist. As a result, the authors assigned the patent a distance of 5. In contrast, McKesson's automated restocking system patent cites 15 different scientific articles — including articles from journals such as the International Journal of Bio-Medical Computing and the American Journal of Hospital Pharmacy — so it received a much lower science distance.

Figure 1: Adapted from Ahmadpoor and Jones, this graphic shows the distance to science for patents based on citation proximity to scientific articles. (Source: Authors)

The distance approach exploits the fact that when a company files for a patent, it has to list all "prior art" on which the patents build, including scientific articles. This mandate provides a direct link between a given patent and any scientific knowledge it exploits.

The third marker was "novelty," which the researchers calculated by analyzing the word used in the patent descriptions. A patent that used new terms and ideas was assigned a higher novelty score than using more familiar language.

Findings

At the macro level, the authors found that "21% of all patents analyzed directly cite a scientific article (D=1), 55% are indirectly based on science (D=2 and D=3) and 24% are not based on science (D=4 or larger)." More interestingly, a D1 patent has an average value that is 82% greater than a D=4 patent. Moreover, this monetary value decreases with the D score. Indeed, "patents with a distance of two or three have average values 44% and 14% higher than those in (D=4), respectively," and when "patents have a distance from science larger than four (D=5, D>5 or unconnected), their average values are between 6% and 16% less valuable than those with a distance of four."

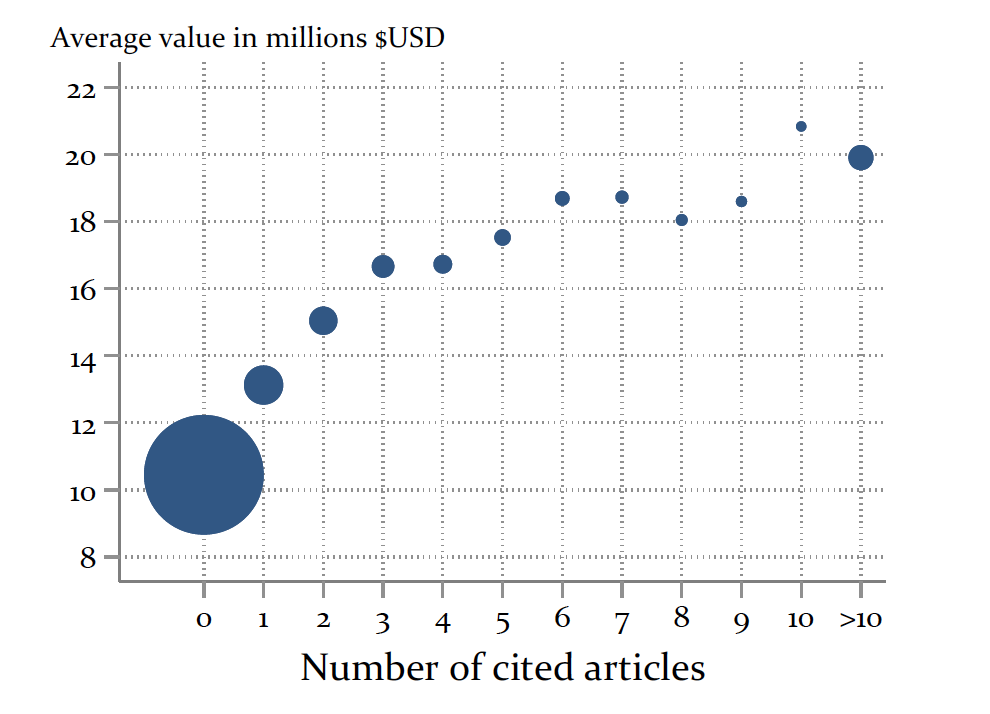

Figure 2: the average patent value for all distances to science along with the number of patents in each distance. (Source: Authors)

Over all, for patents filed within the same technology class in a given year, patents directly based on science (D=1) have an average private value that is 26% larger than patents only loosely related to science (D=4). In other words, the more valuable the technology class is, the higher the percentage of D1 patents it contains.

Figure 3: the average patent value and patents are split by the number of scientific articles cited in the patent. (Source: Authors)

Turning to the novelty question, the authors first established that more novel patents tend to be more valuable. They then concluded that patents with a lower D score tended (on average) to be more novel and thus sources of higher innovation value. In other words, novelty decreased with "distance to science." There is an important nuance to this conclusion, however, because this relationship is non-linear and asymmetric. The asymmetry "suggests that connection to science is associated with middle and above-average novelty, while the extreme novel patents are more likely to be distant from science." Perhaps, the authors speculate, patents "unconnected to science are less constrained in language (or imagination) than inventions tethered by the norms and formalities of science."

Depending on one’s particular risk tolerance, the benefits of basing corporate innovations on scientific research come with either a significant upside or downside, for the authors found an essential risk-reward tradeoff in the data. While "proximity to science [is] associated with greater average private patent values," it is also "associated with more risk i.e., [it is] more likely to end up in extreme outcomes on both ends of the value distribution." As the authors note, "even if the expected value of a science-based patent exceeds that of innovations more distant from science, risk-aversion or path dependence in the internal R&D decision-making process might lead firms to shy away from science-driven R&D, even when the risk-neutral firm would benefit from greater reliance on science." In short, science-based innovation tends to be a high-risk/high-reward activity, which may be why many firms prefer to go it alone.

Conclusions

Basic science is frequently credited with generating technological innovations. From the great innovations born in the space race in the 1960s to CERN's role in the creation of the World Wide Web in the 1990s, there is a storied legacy of the private sector leveraging scientific discovery to bring revolutionary ideas to market. As the authors note, "while scientists since Isaac Newton have been known to see further by standing on the shoulders of giants, our study suggests that many inventors in the private sector see further by standing on the shoulders of science." This statement appears to be increasingly true as companies are spending less on basic research, leaving more of this role to university scientists. As a 2019 HBR article noted, there has been a “significant shift in the U.S. innovation ecosystem.” The U.S. has “moved from an economy where big firms did both scientific research and development toward one with a starker division of labor, where corporations specialize in development, and universities specialize in research.”

Figure 4: National R&D spending 2001-2017 (Source: National Science Foundation/Nature)

With the addition of China's massive scientific ecosystem, the number of potential scientific “shoulders” for companies to stand on increases daily. Foreign competitors welcome the opportunity, apparently. Pre-pandemic, the European Union’s R&D spending had increased yearly for over a decade, and some data suggested that China eclipsed the U.S. in R&D spending in 2019. However, as this study notes, a lot remains to discover about how and when science can and should be used as the foundation for private-sector innovation efforts. These questions are important areas for further study, the authors note correctly. They present both opportunities and challenges to the leaders of R&D teams and the researchers who write the history of innovation.

The Research

Krieger, Joshua Lev, Martin Watzinger, and Monika Schnitzer. "Standing on the Shoulders of Science." Harvard Business School Working Paper, No. 21-128, June 2021.