What happened to Digital Transformation during COVID?

A new report presents a comprehensive view of how Digital Transformation — a pre-pandemic imperative — evolved in 2020 and is returning to the forefront in 2021

Perhaps the most talked-about strategic challenge for C-suite executives prior to the pandemic was Digital Transformation (DT). Senior leaders in a variety of sectors and roles consistently spoke about the need to take advantage of the latest wave of new technologies such as cloud computing, Artificial Intelligence (AI), and e-Commerce to update products, services, and business models. Of course, with the pandemic came new priorities that pushed digital transformation out of the headlines. Yet the forces that put the issue on executives' agendas in 2019 not only remain, but may actually have increased.

As companies start to transition to a post-pandemic world, now is an excellent time to ask how the pandemic has affected DT during the last year and a half. Fortunately, the International Institute for Management Development (better known as “IMD”) has recently published the results of its bi-annual survey on this topic (launched in 2015), and its findings are worth noting.

The Study

IMD's analysis is based on a composite of multiple measures assessing the qualitative and quantitative impacts of digital disruption on the following business sectors:

Media & Entertainment

Financial Services

Hospitality & Tourism

Consumer Packaging Goods

Telecommunication

Transportation & Logistics

Manufacturing

Education

Real Estate & Construction

Energy & Utilities

Professional Services

Technology Products & Services

Retail

Healthcare & Pharmaceuticals

The quantitative measures are drawn from a variety of global industry sources, and the qualitative measures are based on 825 executive surveys conducted by IMD's Global Center for Digital Business Transformation from April 2020 to January 2021. Survey responses were collected at multiple times, sectors, and geographies to "document the challenges brought on by the pandemic and determine how varying levels of digital maturity impacted organizational responses and results."

The Findings

1: Media and Entertainment (M&E) sector remains at the forefront

As shown in Figure 1 below, of all the industries analyzed, the Media and Entertainment sector maintained its top spot as the one experiencing the most digital-driven change, with the pandemic speeding up the already intense (pre-COVID) disruption. For example, the pandemic forced movie studios to find new ways to distribute content, while streaming services gained subscribers during the lockdown. As IMD notes, "one of the first examples of this trend came shortly after the lockdown in China in early 2020. The Chinese movie studio Huanxi struck a deal to have Bytedance release its New Year feature Lost in Russiaacross Bytedance's portfolio of online platforms — a successful move soon copied by competitors." In yet another rapid change, IMD writes, “Disney partially compensated for lost revenue from its theme parks by launching a streaming service, Disney+, which proved to be hugely successful with families at home during lockdowns across the world.”

Figure 1: Executive perceptions of digital disruption in their industries (Source: IMD)

2: Specific sectors actually accelerated DT efforts in 2020

The study notes that several sectors moved closer to the DT cutting-edge. Retail, for example, moved up two spots to second place as a result of the growth in e-commerce. As IMD notes, "COVID-19 accelerated this growth, with record numbers posted all over the world, reaching a third of retail sales in Australia, 30% in the U.K., and 20% in the U.S." Furthermore, “strong platform effects meant that an increasing slice of the online retail market was captured by large e-commerce players, such as Amazon, Alibaba, and Zalando.”

Another big mover was Education, which jumped from eighth to sixth place. As is widely known, the pandemic produced a massive move to virtual learning in all parts of the educational ecosystem. Not surprisingly, "venture capital funding started flowing into this sector, and by March 2021 there were 20 EdTech unicorns in the world, two-thirds of which raised new funding during the pandemic."

Since the Healthcare and Pharma sector dominated headlines in 2020, it is no surprise to see it jump three places to the eighth spot. While telemedicine and med-tech were already increasing pre-pandemic, COVID accelerated the use of technology-based solutions for diagnostics and treatment. Indeed, "more than 20% of digital healthcare start-ups in Europe emerged during the first waves of the pandemic," and "venture capital investment was particularly active in the area of biotech and pharma."

3: Other sectors decelerated DT efforts because of COVID-19

With all the news about distance work and learning in 2020, it may surprise people to learn that some sectors actually became less DT-focused during the crisis. As IMD notes, this deceleration does not mean that “they experienced less digital disruption than in previous years, but that the disruption in these sectors was comparatively lower.”

Among the decelerators is the Technology sector, which dropped from second to fourth place, though IMD notes that this outcome may result simply from the extensive DT the sector had already experienced. In other words, because this sector had dominated venture capital spending between 2015 and 2018, it is possible that by 2020 its leaders were more focused on disrupting others. Indeed, IMD notes that in 2020 Tech companies made "strong moves" into financial services, retail, media, education, and transportation.

Hospitality and Travel was among the sectors that scaled back their DT efforts in 2020. IMD notes that there was little venture capital or external innovation activity in this sector relative to digital, since these industries suffered their worst (non-war) year in modern history. The Travel and Logistics sector fell four places in 2020, which is surprising given all the attention that supply chains received last year. Both sectors demonstrate that companies placed under extreme external pressure focused on core operations — even if for different reasons — rather than strategic transformation.

This last conclusion is supported by IMD's findings. The researchers asked business leaders to categorize investments made in response to the following issues concerning the pandemic:

Business continuity: investments to ensure the survival and viability of the busines

Cost minimization: investments in efficiency, productivity, and digitization of analog processes

Innovation and growth: investments in new products, services, and business models to find new sources of revenue and profit

As Figure 2 below illustrates, prior to COVID, investments in digital focused on business continuity, cost minimization, and innovation and growth were relatively similar. During the pandemic, however, "the focus on digital moved rapidly to support business continuity, while the other two categories only grew slightly." This shift began to wane in January 2021, when investments "in digital tools to support innovation and growth as well as cost minimization had almost caught up with business continuity." It seems that as companies have come out of the crisis, their DT spend is once again focused on using new digital technologies to drive innovation and growth.

Figure 2: Digital Transformation investment focus (Source: IMD)

The importance of digital transformation rises but challenges remain

Beyond the sector rankings, the IMD report highlights other issues. The first is that while the percentage of executives experiencing a transformative or significant impact from digital disruption rose from 27% in 2015 to 90% in 2021, the number of those executives who are happy with their company's response increased only from 25% to 36%. In other words, executives see disruptive forces all around them but are unable to respond appropriately. Indeed, almost 40% of respondents felt that their companies were responding incorrectly to digital threats — about the same result as in the original 2015 survey. The data, notes IMD, "clearly suggest that while digital disruption was top of mind for executive teams, they were struggling to find a way to address it."

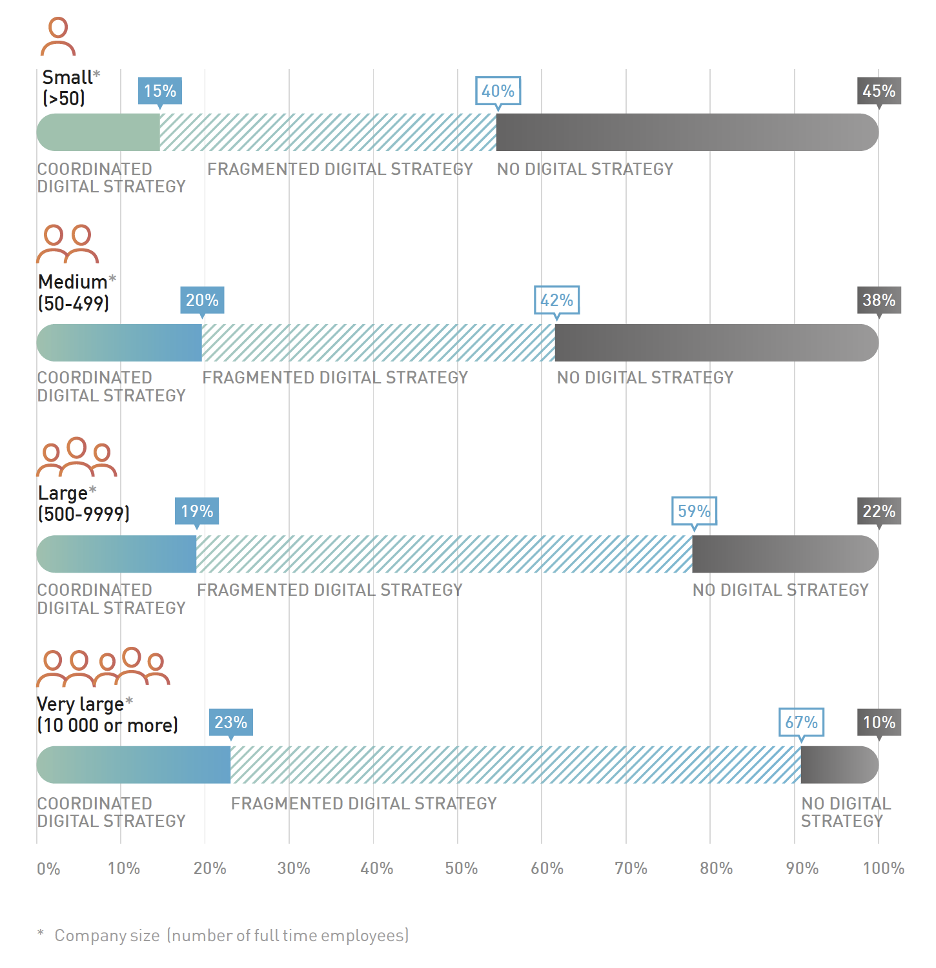

A second issue worth noting is the increasing fragmentation in the way companies are responding to digital disruptions, a phenomenon that may be related to research finding that 87% of digital transformation programs fail to meet their strategic objectives. IMD notes that while there are various reasons why DT efforts are difficult to execute tactically, "there may also be an issue with how these transformations are implemented from a strategic point of view." In other words, because of the poor track record of these efforts, leaders have understandably chosen to chart their own paths rather than sign on to a centrally managed effort, a decision that explains the fragmentation perspectives presented in Figure 3 below. Indeed, “between 2019 and 2021, the percentage of organizations that had a coordinated digital strategy actually fell, while those that reported having a fragmented strategy rose substantially, from 53% of respondents in 2019 to 61% in 2021.” One may speculate that while the pandemic exposed an increasing need to get DT right, many leaders see their peers’ tactical responses growing more fragmented, perhaps leading to doubts about the overall correctness of digital transformation strategies at the company level.

Figure 3: Executive impressions on transformation effort fragmentation (Source: IMD)

The willingness of senior leaders to work the DT challenge independently may also be related to the discrepancy IMD found between how C-level executives gauge their responses to digital threats and how their subordinates see them. Higher-level executives were "much more likely to conclude that they were actively responding to digital disruption, while those lower down in the organization were more likely to say that the response was absent, inappropriate, or merely a copy of the competition." Programmatic fragmentation is also likely connected to a definitional confusion, which is reflected in the various ways that executives describe digital transformation itself. All of the issues noted by IMD are probably related. In other words, without a clear definition of the term and its components, different executives follow different response strategies, which, in the end, leave most of them with the impression that their company’s overall response is inadequate.

The verdict: optimism in a challenging moment

Given the massive disruptions caused by the pandemic, it is natural to assume that it did accelerate DT (at least to some degree) across most sectors, and 83% of executives agreed with this point of view in the January 2021 survey. Perhaps because of the disruption levels, the pandemic also increased the perceived importance of DT efforts. Before the pandemic, 68% of senior leaders saw DT as a top priority, and this number increased to 90% in early 2021. Of course, relative to virtual work and learning, the pandemic rapidly lowered barriers to DT and forced most companies to deploy digital models that were unimaginable in 2019. However, only a few sectors — media, banking, telcos, retailers, and tech — experienced truly transformative impacts. Other sectors continued as before or even delayed their journey towards a digital future — even as 70% of respondents believe that digital technologies are already transforming their industries (up from less than 16% in 2015).

Despite the concerns about fragmentation and strategic direction noted by respondents, IMD finds most leaders report a positive outlook for the future. As shown in Figure 4 below, when asked how confident they were that they would “enjoy the positive effects of digital disruption compared with how concerned they were that they would experience the negative effects,” most executives expect the positive.

Figure 4: Executive “concern versus confidence” about their digital future (Source: IMD)

One reason for this positive outlook is hinted at in a (similar) study by McKinsey & Co. taken at the height of the pandemic. At the time, leaders reported that one silver lining of the crisis was that it broke down many pre-existing organizational barriers to DT efforts. Given license to move at speed, many executives felt a new freedom to push transformational efforts forward. Indeed, the McKinsey authors noted that when respondents were asked why their organizations had not implemented these changes before the crisis, just over half said that they just weren’t a top business priority. The crisis, however, “removed this barrier: only 14 percent of all respondents say a lack of leadership alignment hindered the actual implementation of these changes.”

This newfound flexibility may explain the positive outlook IMD discovered, especially when combined with post-pandemic relief and a sense that 2020 opened up the set of strategic possibilities. Whatever the causes, the IMD’s new research finds that as COVID-19 (we hope) winds down, Digital Transformation — one of the major pre-pandemic agenda items across the C-suite — is quickly returning to the forefront.

The Research

Digital Vortex 2021: Digital Disruption in a COVID World. IMD Global Center for Digital Business Transformation, 2021. https://imd.cld.bz/Digital-Vortex-2021/24/